The FinCon Group provides companies – particularly SMEs and start-ups – with efficient, fast, and transparent access to urgently needed expansion or project capital through reverse mergers.

What Are Reverse Mergers?

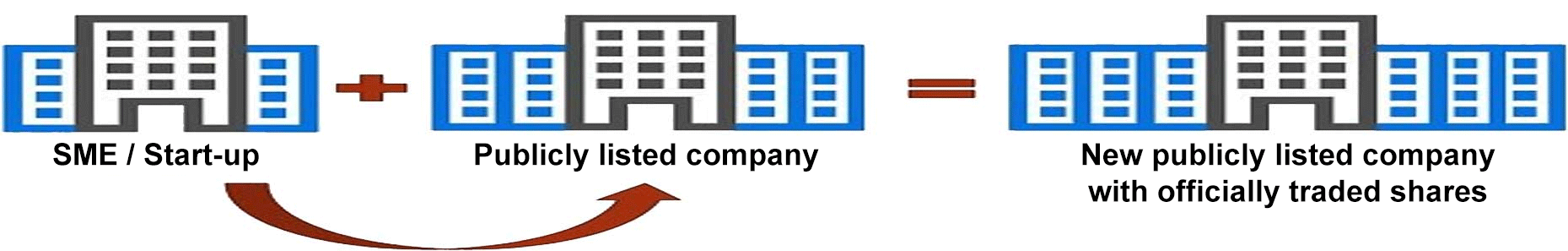

A Reverse Merger (RM) – also known as a Reverse Takeover (RTO) or Backdoor Listing – allows a private company to become publicly listed in an extraordinarily short period of time, gaining access within just weeks to non-repayable, interest-free equity capital via the capital markets. The process involves significantly lower cost and complexity than traditional financing routes, such as a classic IPO (Initial Public Offering) or venture capital rounds.

In essence, a private company – often a growth-focused SME or start-up – merges with an existing publicly traded entity and thereby immediately attains public company status.

A reverse merger not only reduces bureaucracy, cost, and regulatory obligations but also opens the fastest possible route to expansion or start-up funding via the stock market. Reverse mergers are among the M&A transactions considered the “crown discipline” of investment banking and corporate finance.

For more in-depth details, please refer to our information page for capital-seeking companies: “Why Reverse Merger and How It Works.”

Process

When the management of an SME or the founders of a start-up contact us regarding reverse merger financing, we first evaluate the project’s suitability through an initial online meeting.

If the prerequisites are met – i.e., all required documentation (such as corporate records and a business plan) is available and management approves the process – both parties sign an individualized financing agreement.

The entire execution of the reverse merger is handled exclusively by FinCon Group: from contract signing, through selection and due diligence of a suitable public shell, legal structuring and negotiations with the sellers, to the final acquisition.

At completion, our investors receive the contractually guaranteed multiple of their invested capital – either in the form of transferable, publicly tradable shares or, if preferred, as an equivalent cash payout.

Costs of a Reverse Merger

Executing a reverse merger involves significant costs, including:

-

Acquisition of majority ownership (typically at least 90%) in a high-quality publicly traded company (“public shell”).

-

Due diligence and structuring costs for specialized law firms, auditors, and financial advisors.

-

Regulatory expenses for filings, approvals, and listing adjustments with the exchange.

-

Comprehensive marketing and communications efforts to position the new public company in the capital markets and ensure successful share placement – including collaboration with investment banks and broker-dealers.

-

Working capital for strategic post-merger development to ensure market growth and meet institutional investor expectations.

-

Reserve funds to cover unforeseen market or structural adjustments during the process.

These total costs far exceed what most SMEs or start-ups could provide from their own resources.

That’s where our participating investors come in – providing the full required capital without any upfront cost to the company.

This Is Your Opportunity

As an investor, you have the opportunity to participate in the financing of reverse mergers and benefit from this unique bridge-financing model.

Participation is available starting from a minimum investment of €5 million / USD 5 million.

According to the investment agreement and our general terms, your capital is always contributed at a substantial discount – typically around 90% below fair market value.

This means: after successful completion of the reverse merger, you receive freely tradable shares of the acquired public company at a multiple of your original investment – typically representing

a tenfold return (10x ROI).

If preferred, an equivalent cash payout can also be arranged.

Duration of a Reverse Merger Process

A suitable reverse merger can generally be completed within just a few weeks – ideally within about 30 days.

However, before the actual transaction (the acquisition of the public shell) takes place, several preparatory reviews are conducted:

-

A suitable shell must be identified whose share volume significantly exceeds the capital required for expansion or start-up development – including adequate reserves – while maintaining majority voting and equity control.

-

A comprehensive due diligence follows: tax authorities, credit bureaus, regulators, and courts are consulted to ensure the entity is free from debts or legacy liabilities.

-

In parallel, our investors provide the capital for acquisition, structuring, and supporting marketing.

-

The final phase includes negotiations with remaining shareholders, particularly regarding lock-up agreements to prevent immediate resale of remaining shares and ensure price stability.

-

Finally, all acquisition contracts are executed and the transaction is formally closed.

Typically, only a few weeks pass between the initial investment and completion.

For transparency and integrity, our investment agreements state a maximum term of up to one year.

At the end, investors receive shares representing the multiple value of their original investment – typically 10x ROI – or, if preferred, a cash settlement.

Now Let’s Talk About Risk – and Why Traditional Market Risks Do Not Apply

All FinCon reverse merger transactions are conducted exclusively with verified, reputable companies – primarily SMEs and start-ups with sustainable, forward-looking expansion strategies. Business plans are carefully reviewed (or prepared by us if necessary), including in-depth market analysis.

Likewise, every potential shell company undergoes full due diligence to ensure the absence of debt, hidden liabilities, or compliance issues.

Your investment capital remains fully secured until final contract execution. Funds are released only after all reviews are completed, a clean public shell is selected, and all agreements – drafted by our legal teams – are duly executed.

Should a project fail to close under exceptional circumstances, your full investment is immediately returned.

The entire process – from capital allocation to transaction completion and delivery of freely tradable shares or the agreed cash payout – is carried out under FinCon’s direct control.

No third party ever gains access to your funds.

What makes this model truly exceptional: your return is not dependent on typical market factors such as company profits, sales performance, stock price fluctuations, or currency volatility.

Your profit is generated solely through the successful completion of the reverse merger, delivering the contractually guaranteed return – typically a tenfold increase (10x ROI).

Any theoretical residual risks would only exist under extreme, virtually impossible conditions – such as a global financial collapse or a total legal ban on mergers in the United States.

Likewise, misappropriation of funds is inconceivable: our companies consistently generate revenues and profits far exceeding the total sum of all investor capital.