Phase 1 – Legal & Structural Setup

|

Step |

Key Actions |

Primary Professionals |

|

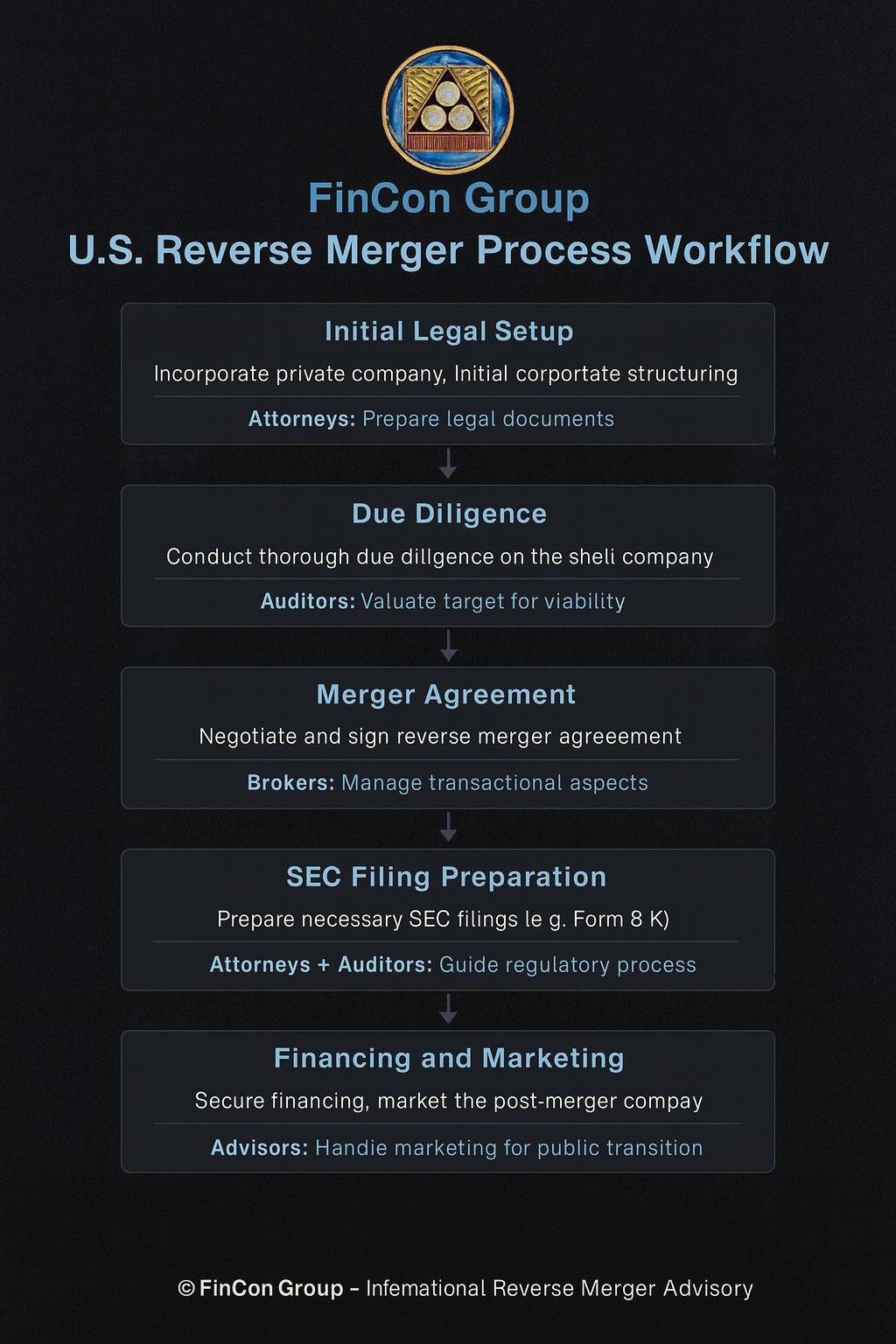

1.1 Entity Formation / Reorganization |

Incorporate or redomicile into a U.S. legal entity (usually Delaware C-Corp). Secure EIN, registered agent, and bank account. |

🇺🇸 Corporate service provider, U.S. securities attorney, accountant |

|

1.2 Initial Legal Review & Structuring |

Determine best merger structure (share exchange, triangular merger, or direct takeover). Identify target exchange (OTCQB, NASDAQ, NYSE). |

Securities attorney, M&A advisor |

|

1.3 Confidential Information Preparation |

Prepare business plan, corporate documents, and pre-audit financials for due diligence. |

Internal finance team, financial advisor, attorney |

Phase 2 – Target Identification & Due Diligence

|

Step |

Key Actions |

Primary Professionals |

|

2.1 Identify Suitable Public Shell |

Locate a clean SEC-reporting public shell (no debt, no lawsuits). |

M&A advisor, law firm, shell provider |

|

2.2 Legal & Financial Due Diligence |

Verify compliance, outstanding liabilities, and cap table of the shell. |

Securities attorney, PCAOB auditor |

|

2.3 Valuation & Deal Structuring |

Negotiate price, share ratio, and control structure (majority ownership by private company). |

M&A advisor, investment banker, attorney |

Phase 3 – Pre-Merger Compliance & Audit

|

Step |

Key Actions |

Primary Professionals |

|

3.1 Financial Audit (PCAOB) |

Audit last two fiscal years of the private company under U.S. GAAP. |

PCAOB-registered CPA firm |

|

3.2 Preparation of SEC Filings |

Draft merger documents, disclosure statements, and Form 8-K templates. |

Securities attorney, auditor |

|

3.3 Capital Raise (Optional) |

If desired, arrange PIPE or Reg D / Reg S private placement to fund post-merger growth. |

Broker-dealer, investment banker, attorney |

Phase 4 – Merger Execution

|

Step |

Key Actions |

Primary Professionals |

|

4.1 Signing the Merger / Share Exchange Agreement |

Legal merger between private company and public shell. Board and shareholder approval obtained. |

Securities attorney, corporate secretary |

|

4.2 Transfer of Control |

New management installed, old officers resign, control block transferred. |

Attorney, transfer agent |

|

4.3 Super 8-K Filing with SEC |

Within 4 business days after closing: file Form 8-K with full audited financials and new company disclosure. |

Attorney, auditor |

|

4.4 FINRA Coordination |

Apply for name and ticker symbol change, CUSIP update, and DTC eligibility. |

Broker-dealer, transfer agent, FINRA liaison |

Phase 5 – Post-Merger Integration

|

Step |

Key Actions |

Primary Professionals |

|

5.1 Corporate Realignment |

Rebrand entity, update website, board, and internal governance. |

Corporate secretary, IR team |

|

5.2 Market Maker Sponsorship |

File Form 211 to resume or initiate public trading (if OTC). |

Broker-dealer / market maker |

|

5.3 Compliance Filings |

File periodic SEC reports (Form 10-Q, 10-K, 8-K) and maintain good standing. |

Attorney, CPA / auditor |

|

5.4 Investor Communications |

Launch press releases, investor deck, and roadshows. Maintain investor website. |

IR / PR agency, management team |

Phase 6 – Capital Market Expansion

|

Step |

Key Actions |

Primary Professionals |

|

6.1 Secondary Offerings |

Conduct follow-on equity offerings (Reg A+, S-1 shelf, or PIPEs). |

Investment banker, attorney |

|

6.2 Up-Listing / Exchange Upgrade |

Transition from OTC to NASDAQ or NYSE American once requirements are met. |

Attorney, auditor, broker-dealer |

|

6.3 Institutional & Retail Investor Relations |

Strengthen liquidity, analyst coverage, and institutional partnerships. |

IR agency, investment banker, PR team |

🧩 Overview: Professionals by Role

|

Professional / Entity |

Core Responsibility |

Typical Stage |

|

Securities Attorney |

Legal structure, SEC filings, compliance |

All phases |

|

PCAOB Auditor |

Financial audits, GAAP conversion |

Phase 3–5 |

|

Broker-Dealer |

Trading, Form 211, capital raise |

Phase 4–6 |

|

M&A Advisor / Banker |

Shell sourcing, negotiation, valuation |

Phase 2–4 |

|

Transfer Agent |

Share registry, ticker update |

Phase 4–5 |

|

IR / PR Agency |

Investor communication, media strategy |

Phase 5–6 |

|

Corporate Secretary / Service Provider |

Incorporation, compliance filings |

Phase 1–5 |

|

Financial Advisor / Accountant |

Pre-audit setup, modeling |

Phase 1–3 |

|

Market Maker |

Initial trading sponsor |

Phase 5 |

|

Shell Provider / Consultant |

Identify clean shells |

Phase 2 |

🔄 Typical Timeline (Approximate)

|

Phase |

Duration |

|

Initial structuring & due diligence |

3–5 weeks |

|

Audits & SEC filings |

4–8 weeks |

|

Merger execution & filings |

2–3 weeks |

|

Post-merger integration & trading start |

2–4 weeks |

→ Total estimated process: 3–4 months (well-prepared) |

⚙️ End Result

✅ Fully reporting, publicly traded U.S. entity

✅ Access to institutional and retail capital markets

✅ Liquidity for investors and founders

✅ Legally compliant structure for global expansion